Choosing the right mortgage lender Quiz

Test Your Knowledge

Question of

Understanding Mortgage Lender Types

Banks and Credit Unions

Are you on the hunt for a mortgage lender that aligns with your homeownership dreams? Look no further than your local banks and credit unions! These institutions are pillars in the real-estate financing landscape, offering competitive interest rate offers that could save you a fortune over the life of your loan. Don't miss out on potentially lower rates and personalized service that could make all the difference in your home-buying journey!

But it's not just about numbers; it's about the experience! Customer service experience at these establishments is often second to none. Imagine walking into a place where everyone knows your name, ready to guide you through the labyrinth of home financing. Banks and credit unions pride themselves on building relationships, ensuring you feel supported every step of the way. This can be incredibly reassuring, especially for first-time homebuyers who need that extra bit of guidance!

Mortgage Brokers

Variety is the spice of life, and when it comes to mortgage brokers, variety is what they deliver! These financial maestros work with multiple lenders to bring you an array of loan products. Whether you're looking for a conventional loan, FHA, VA, or something more specialized, mortgage brokers are your go-to experts. They'll fight to find you the best deal, tailored just for your situation. Don't settle for one-size-fits-all solutions; explore your options with a mortgage broker!

However, let's talk about broker fees and costs because transparency is key! Yes, mortgage brokers provide an invaluable service, but they also charge for their expertise. It's crucial to understand their fee structure upfront. Some may charge a flat fee, while others might receive a commission from the lender. Ask questions, get clarity on costs, and ensure you're getting top-notch service for your hard-earned money!

Online Lenders

Welcome to the digital age of home financing! Online lenders are revolutionizing the mortgage industry with their convenience and speed. Imagine applying for a loan from the comfort of your couch, with just a few clicks it's possible today! You can compare rates, fill out applications, and receive approvals rapidly. For those who value efficiency and quick turnarounds, online lenders are a game-changer in securing that dream home without delay!

And let's not overlook online customer support it's robust and responsive! While you might not have face-to-face interaction, many online lenders offer comprehensive support via chatbots, email, or phone calls. You'll get answers to your questions and assistance throughout the process without ever having to leave home. This level of convenience is unmatched and caters perfectly to the busy lifestyles of modern homebuyers.

- Interest Rates: Compare them meticulously.

- Fees: Understand all associated costs.

- Reputation: Read reviews and ask for recommendations.

- Customer Support: Ensure they offer robust assistance.

- User Experience: The application process should be smooth.

Evaluating Lender Credibility

Licensing and Accreditation

When you're on the hunt for the right mortgage lender, it's like embarking on a quest for a trustworthy ally in the world of real estate finance. First and foremost, check their licensing and accreditation! It's non-negotiable. Every credible lender must adhere to stringent state and federal regulations it's the bedrock of their legitimacy. Ensure they are licensed in your state and meet all regulatory requirements. This isn't just bureaucracy; it's your peace of mind!

But wait, there's more! Dive into their professional endorsements. Are they recognized by leading industry bodies? Have they bagged awards that make them stand out from the crowd? These accolades are like badges of honor, showcasing their commitment to excellence in the mortgage lending arena. You want a lender who not only plays by the rules but shines while doing so!

Remember, compliance with state and federal laws is not just a formality; it is an assurance that the lender operates with integrity and transparency. A lender without proper credentials is a red flag waving furiously in the wind don't ignore it! Make sure every box is ticked before you proceed.

Customer Reviews and Testimonials

Now, lets talk about reputation its everything! Customer reviews and testimonials are like gold dust when choosing your mortgage lender. They provide unfiltered insights into other borrowers' experiences. High satisfaction ratings? Thats what were talking about! It means they're doing something right, from customer service to competitive rates.

But let's be real no lender is perfect. What truly matters is how they handle complaints and issues. Do they resolve matters swiftly and fairly? Are they committed to turning a negative into a positive? This speaks volumes about their dedication to customer satisfaction. A lender who listens and acts on feedback is a lender worth considering!

- Look for patterns: If multiple reviews mention the same pros or cons, take note!

- Recent reviews matter: Lenders can change over time, so focus on the latest feedback.

- The response says a lot: Check if and how the lender replies to both positive and negative reviews.

A plethora of positive testimonials should make your heart race with excitement this could be 'The One.' But remember, balance those rave reviews with some critical thinking. It's about finding the truth amidst the noise.

Financial Health and Stability

Talking about financial health isn't just for economists it's crucial when picking your mortgage lender too! You want someone whos been around the block, with a track record of stability even through economic downturns. Company longevity signals experience and resilience; these guys know how to navigate choppy financial waters!

Dig into their annual reports and public records; they're not just pages filled with numbers but stories of fiscal fortitude or warning tales of woe. What you're looking for is sustained growth, solid capital reserves, and prudent management practices. These factors are like a fortress protecting your investment in your home.

You want a lender that stands as firm as bedrock beneath your feet because when it comes to one of life's biggest investments, you need unwavering support. Don't settle for less; demand transparency and evidence of financial prowess before making your choice!

Comparing Loan Options and Terms

When it comes to diving into the real estate market, selecting the right mortgage lender is like finding a golden key to your dream home! It's not just about snagging a loan; it's about securing a financial partnership that can make or break your homeownership experience. Let's embark on an exhilarating journey through the maze of mortgage options and terms that could shape your future!

Fixed-Rate vs. Adjustable-Rate Mortgages

Interest Rate Predictability is a HUGE deal when choosing between a Fixed-Rate and an Adjustable-Rate Mortgage (ARM). With a fixed-rate mortgage, you're locking in your interest rate for the life of the loan talk about stability! You'll sleep like a baby knowing exactly what your payment will be each month, no surprises! This is perfect for those who crave consistency in their financial planning.

On the flip side, ARMs are like a walk on the wild side with interest rates that change over time based on market conditions. Initially, you might get a lower rate compared to fixed-rate mortgages, which can be super tempting. But remember, this could change, and rates could climb higher. So if you're someone who likes to live on the edge or plans to move before rates adjust, an ARM might just be your adrenaline rush!

Long-Term Financial Planning is where it gets serious. With a fixed-rate mortgage, long-term budgeting becomes as easy as pie. You're setting yourself up for success by eliminating the guesswork from your financial future. However, if you're confident that interest rates will fall or you'll be upgrading your home soon, an ARM could offer significant savings in the short term. The choice is yours stability or potential savings? Make it count!

Government-Backed vs. Conventional Loans

Down Payment Requirements can be a game-changer for many aspiring homeowners. Government-backed loans like FHA, VA, and USDA loans often allow for lower down payments we're talking as little as 3.5% down or even zero down for some programs! This is fantastic news if you haven't been able to save up a hefty down payment.

Loan Eligibility Criteria tends to be more flexible with government-backed loans too. They're designed to help more people step onto the property ladder by offering leniency with credit scores and income levels. Conventional loans usually have stricter criteria but don't let that deter you! They often come with competitive interest rates and lower insurance costs if you've got a solid financial profile.

Special Programs for First-Time Buyers

- Incentives and Grants: Attention first-time buyers! There are special programs out there just for YOU! Many lenders offer incentives like closing cost assistance or grants that don't need to be repaid free money, folks!

- Qualification Guidelines: These programs often have qualification guidelines tailored to help newbies in the housing market. We're talking lower income and purchase price limits to ensure these benefits go to those who need them most.

If you're ready to take the plunge into homeownership, understanding these mortgage options is crucial. It's not just about getting any loan; it's about finding THE ONE that fits like Cinderella's slipper perfectly suited for your financial situation and goals.

The world of mortgages doesn't have to be intimidating. With this knowledge in hand, you're equipped to make informed decisions that lead to wise investments and happy homecomings. So get out there and find that lender who will champion your homeownership dreams with the ideal loan option for YOU!

Understanding Fees and Costs

Origination and Underwriting Fees

When you're diving into the world of mortgages, one thing is crystal clear: understanding the fees associated with your loan is CRUCIAL! Origination and underwriting fees are the upfront charges that lenders impose for processing your mortgage application. These fees can vary WILDLY from lender to lender, so it's essential to get a grip on them early in the game. They cover the cost of evaluating, preparing, and submitting your loan application. It's not just about finding a lender; it's about finding one that offers competitive rates without compromising on service!

Calculation Methods for these fees can be either a flat rate or a percentage of the loan amount, typically ranging between 0.5% to 1%. This might seem small at first glance, but on a large loan, this can mean thousands of dollars! Make sure you ask each lender how they calculate their fees so you can compare apples to apples. This is where your negotiation skills come into play don't be afraid to haggle and fight for a better deal!

Now let's talk about Comparison Across Lenders . You must shop around! I cannot stress this enough SHOP AROUND! Just like you wouldn't buy the first car you see, don't go with the first mortgage lender that makes an offer. Compare those origination and underwriting fees because even a small difference in percentage points can lead to significant savings over the life of your loan. Be bold, be savvy, and make lenders compete for YOUR business!

Closing Costs and Prepaid Items

The finish line of your mortgage journey includes closing costs and prepaid items and trust me, they're just as important as the starting blocks! Closing costs encompass a variety of expenses such as appraisal fees, title searches, title insurance, surveys, taxes, and credit report charges. Prepaid items might include homeowners insurance premiums or property taxes that need to be paid upfront.

To get a handle on your Estimating Total Closing Expenses , you'll want to obtain a Good Faith Estimate (GFE) from your lender. This document provides an itemized list of expected fees and is pure gold when budgeting for your home purchase. Remember, knowledge is power knowing these costs upfront empowers you to make informed decisions!

If you're looking to keep more money in your pocket (and who isn't?), then let's dive into some Strategies to Reduce Out-of-Pocket Costs . One strategy is to negotiate with the seller to pay some of the closing costs it's all part of the real estate dance! Another tactic could be rolling some of these costs into your mortgage if possible. And don't forget about lender credits; sometimes lenders will offer credits in exchange for a slightly higher interest rate.

Penalty Clauses and Fine Print

The devil is in the details or in this case, in the fine print! Penalty clauses are sneaky little things tucked away in mortgage agreements that can pack quite a punch if you're not aware of them. Understanding these penalties can save you from future financial headaches.

Prepayment Penalties are charges incurred for paying off your mortgage early. Yes, you heard that right you could be penalized for being financially responsible! Some lenders include prepayment penalties to deter borrowers from refinancing or paying off their loans ahead of schedule. Always ask upfront if there are prepayment penalties so you can avoid any nasty surprises down the road.

- Avoiding Prepayment Penalties: Look for loans without these penalties or negotiate their removal.

- Lender Transparency: Ensure full disclosure of any penalty clauses before signing on the dotted line.

- Long-Term Planning: Consider how long you plan to stay in your home when choosing a mortgage with or without prepayment penalties.

We also need to talk about those pesky Late Payment Fees . If you miss a payment deadline, even by a day, some lenders will hit you with late fees that add up faster than you can say "mortgage." It's imperative to understand how much these fees are and how quickly they accrue after a missed payment deadline. Set up automatic payments if possible because staying on top of your payments should be non-negotiable!

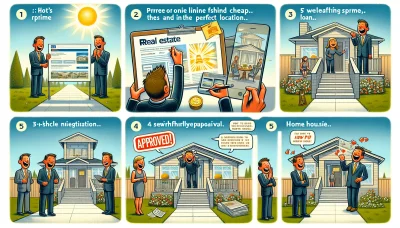

Navigating the Application Process

Pre-Approval Importance

Get ahead in the game! Pre-approval is your golden ticket in the competitive real estate market. It's not just a preliminary step; it's a strategic move that catapults you to the front of the line when you find your dream home. By securing pre-approval, you're essentially wielding a powerful tool that says, "I'm serious, and I have the backing to prove it!" Lenders will evaluate your financial health, giving you a clear picture of what you can afford this is where choosing the right mortgage lender becomes pivotal.

Strengthening Buying Power Oh, it's like having a financial superpower! With pre-approval, sellers will view you as a committed buyer with the means to close the deal. This can be particularly crucial in hot markets where multiple offers are as common as morning coffee runs. Your pre-approval could be the deciding factor that sets you apart from the crowd!

Identifying Potential Issues Early It's all about foresight! Pre-approval can reveal any credit or financial hiccups before they become full-blown obstacles. Addressing these issues early on with your mortgage lender ensures smoother sailing when you're ready to make an offer. Remember, knowledge is power especially when it comes to large investments like real estate.

Document Collection and Verification

Dive into the nitty-gritty with document collection and verification! This stage is critical in choosing the right mortgage lender as they guide you through the maze of paperwork. Ensuring everything is in order can make or break your application process.

Employment and Income Verification Your lender needs to know you're good for it! They'll ask for proof of employment and income to ensure that you can handle the monthly payments. Be prepared to show recent pay stubs, tax returns, and W-2 forms. The right lender will help clarify exactly what's needed and why, making sure there are no surprises down the line.

Asset and Debt Documentation It's time to lay all your cards on the table. Lenders will want a comprehensive look at your assets and debts. This includes bank statements, investment accounts, credit card statements, auto loans, student loans basically anything that paints a picture of your financial health. A thorough lender will meticulously review this information to provide a loan package that aligns with your financial scenario.

Timelines and Deadlines

The clock is ticking! Understanding timelines and deadlines is essential when navigating through mortgage applications. Each step of this journey has its own timeframe, and knowing these can help maintain momentum towards homeownership.

Expected Processing Timeframes Every lender has their own rhythm but don't worry; they'll keep you in sync! From application submission to final approval, they'll outline each phase of the process so you're never left wondering what comes next. Anticipate these stages carefully because timing is everything!

- Application Review: The initial phase where lenders assess your suitability.

- Appraisal Scheduling: Determining the value of your potential new home.

- Underwriting: The critical evaluation of all your submitted documents.

- Closing: The grand finale where keys change hands!

Impact of Delays on Purchasing Delays can be more than just annoying; they can be deal-breakers! A missed deadline might mean missing out on that perfect property. That's why working with a proactive lender who understands urgency is non-negotiable. They'll push things along while ensuring every 'i' is dotted and every 't' crossed because in real estate timing isn't just important; it's everything!

Building a Relationship with Your Lender

Communication and Responsiveness

Let's dive right in! When you're on the hunt for the perfect mortgage lender, communication is KEY! You need someone who's not just there to talk but to listensomeone who's ready to answer your burning questions and address your deepest concerns with lightning speed. Imagine having a lender who's always on their toes, eager to provide you with the crystal-clear information you need to make informed decisions. That's what we're talking about!

We're not just looking for any lender; we want a responsiveness champion! A lender who is available at the drop of a hat, ready to guide you through the labyrinth of interest rates, loan terms, and payment plans. This isn't just about getting answers; it's about getting them fast, getting them right, and getting them in a way that makes sense to YOU!

And let's be realclarity is non-negotiable. You deserve information exchange thats as clear as a bell! No jargon, no beating around the bushjust straight-up facts and guidance that pave the way to your dream home. With this kind of communication superpower at your side, you'll be unstoppable!

Trust and Transparency

Now, hold onto your hats because we're getting into the trust zone! Trust and transparency with your mortgage lender are like peanut butter and jellythey just belong together. You want a lender who lays all their cards on the tablethe full disclosure of terms and conditions should be a given, not a bonus!

You need honestypure, unadulterated honesty when it comes to advising on loan fit. Your lender should be like a beacon of truth, illuminating the path that aligns perfectly with your financial situation. No hidden fees, no surprise clausesjust transparent advice that has YOUR best interests at heart.

And heres the kicker: trust isn't built overnight. Its earned through consistent, reliable guidance that stands the test of time. Your mortgage journey isn't just about closing a deal; it's about forging an alliance with a lender who becomes your go-to for all things real estate finance!

Ongoing Support and Services

The journey doesn't end when you get the keys; oh no, its just beginning! That's why ongoing support from your mortgage lender is absolutely vital. Imagine having an ally by your side as you navigate homeownershipa partner who's ready to assist with future refinancing needs or adapt to changing market conditions.

Your ideal lender isn't just there for the transaction; they're there for LIFE! They offer access to homeownership education resources that empower you, enriching your knowledge so you can make savvy decisions down the road. Were talking workshops, webinars, articlesall designed to keep you on top of your game!

- Refinancing Assistance: A great lender offers tools and advice for when its time to reassess your mortgage.

- Educational Resources: They provide valuable learning materials that help demystify the complexities of homeownership.

- Ongoing Support: They ensure you have someone to turn to as your financial needs evolve over time.

This isn't just about loans; its about building a lasting partnership that grows as you do. With ongoing support from a top-notch lender, you'll have peace of mind knowing that help is always just a phone call or email away. Now THAT'S what I call service!