Can you buy a home with a 500 credit score Quiz

Test Your Knowledge

Question of

Understanding Credit Scores and Home Buying

What is a Credit Score?

The Definition of a Credit Score: A credit score is a numerical expression that represents the creditworthiness of an individual, derived from an analysis of the person's credit files. It's like a financial report card, giving lenders a quick snapshot of your borrowing history.

Factors Influencing Your Credit Score: Numerous factors impact your credit score, including payment history, outstanding debt, length of credit history, types of credit used, and recent inquiries for new credit. Each element plays a crucial role in the calculation of your score.

Different Credit Scoring Models: There are various models for calculating credit scores with FICO and VantageScore being the most prevalent. While methodologies may differ slightly, they all aim to predict the risk associated with extending you credit.

How Credit Scores Affect Home Buying

The Role of Credit Scores in Mortgage Approval: When you apply for a mortgage, lenders will scrutinize your credit score to determine if you're eligible for a loan and under what terms. A higher score indicates less risk to the lender, often resulting in better loan conditions.

Interest Rates and Credit Scores: Your credit score directly affects the interest rate you'll be offered on a mortgage. Higher scores typically unlock lower rates which can save you thousands over the life of your loan.

Credit Score Requirements for Various Loan Types: Different home loans have varying credit requirements. Conventional loans usually require higher scores, while FHA loans might be more lenient. Knowing these requirements is crucial when shopping for a mortgage.

The Implications of a 500 Credit Score

Challenges of a Low Credit Score: A 500 credit score is considered well below the average and might significantly limit your options for home financing. Lenders view this as an indication of high financial risk.

Potential Loan Options with a 500 Credit Score: Even with a 500 score, some options remain such as FHA loans which are designed for low-to-moderate-income borrowers with lower credit scores.

- Maintain on-time payments for all debts.

- Avoid maxing out credit cards; keep balances low.

- Limited new accounts and hard inquiries on your credit report.

- Mix different types of credit responsibly to show diverse financial handling.

- Regularly check your credit report for errors and dispute any inaccuracies immediately.

- Become an authorized user on someone else's account to benefit from their good credit habits.

- Consider secured credit cards or small installment loans to build or rebuild your credit profile.

Strategies for Improving Your Credit Score: If you find yourself with a 500 credit score, don't lose hope! You can adopt strategies to improve it over time. Consistent effort and responsible financial behavior can gradually build up your score, opening up better opportunities for home buying in the future.

Exploring Mortgage Options with a Low Credit Score

FHA Loans: A Viable Option?

Understanding FHA Loan Requirements

FHA loans are a beacon of hope for individuals with low credit scores. These government-backed mortgages allow lower credit thresholds, making homeownership accessible. With the FHA's backing, lenders are more willing to take on what they would otherwise consider high-risk borrowers.

The eligibility criteria for an FHA loan extend beyond credit scores. Potential borrowers must also meet guidelines related to employment history, debt-to-income ratio, and property standards. It's essential to understand these requirements to determine if you qualify.

The Down Payment for FHA Loans with a 500 Credit Score

A credit score of 500 doesn't lock you out of the housing market! With an FHA loan, you can still make a purchase with a down payment as low as 10%. This is significantly lower than conventional loans that typically require higher credit scores and down payments.

However, improving your credit score can lead to even greater benefits. A score of at least 580 may drop the down payment requirement to an incredible 3.5%. Every point counts when it comes to preparing for homeownership!

FHA Loan Interest Rates and Insurance Premiums

While FHA loans have more lenient requirements, they come with certain costs. Borrowers can expect higher interest rates compared to those with stellar credit. Additionally, mortgage insurance premiums (MIP) are mandatory and need consideration in your budgeting.

MIP is a two-fold expense involving an upfront payment at closing and an annual premium spread over monthly payments. This insurance provides protection for lenders against potential default, which is crucial given the risk associated with low credit scores.

Alternative Financing Solutions

Subprime Mortgages: Pros and Cons

Subprime mortgages cater to individuals with less-than-perfect credit histories. They offer a pathway to homeownership where traditional lending has barriers. However, they typically carry higher interest rates as lenders offset the increased risk.

Borrowers should tread carefully; the allure of qualifying does not overshadow the potential for steep financial strain due to elevated rates. Ensure you fully understand the terms before diving into a subprime mortgage agreement.

Owner Financing: How It Works

Owner financing bypasses traditional lending institutions altogether. In this arrangement, the seller acts as the lender, allowing buyers to make payments directly to them over time. This can be particularly advantageous if you're facing difficulties securing a bank loan due to your credit score.

This method often involves negotiating terms directly with the seller, offering flexibility in structuring the loan agreement. Be vigilant about contract conditions and seek legal advice to protect your interests in these deals.

Hard Money Lenders: What to Expect

Hard money lenders provide another option for those unable to secure conventional financing. These are short-term loans primarily based on property value rather than borrower's creditworthiness. They're typically used by investors looking for quick purchases or renovations.

- Elevated Interest Rates: Hard money loans come with higher interest rates due to their riskier nature.

- Limited Loan Term: The repayment period is often short, usually around 12 months, necessitating prompt refinancing or sale of the property.

- Larger Down Payment: Expect larger down payments as lenders want assurance against default risks associated with low credit scores.

- Property as Collateral: Your investment serves as collateral; failure to repay can result in loss of property.

- Rapid Funding Times: These loans can be funded quickly, beneficial for competitive real estate markets or auction purchases.

Government-Assisted Home Buying Programs

VA Loans for Veterans and Service Members

Veterans and active military members have exclusive access to VA loans - an incredible benefit without requiring any down payment or mortgage insurance premiums. Although there's no minimum credit score set by the VA, lenders typically look for scores around 620 or higher.

The absence of mortgage insurance and lenient terms make VA loans highly attractive options that honor our service members' commitment by easing their path toward homeownership.

USDA Loans for Rural Homebuyers

If rural living is calling your name, USDA loans might be your answer! Aimed at promoting rural development, these loans offer zero down payment options for eligible properties and buyers earning below a certain income threshold.

Credit requirements are relatively flexible; however, prospective borrowers should demonstrate a consistent ability to pay their debts on time despite their low scores. USDA loans are an excellent tool for rural homebuyers striving towards owning their piece of the countryside dream!

State and Local Homebuyer Assistance Programs

Navigating home buying with a low credit score becomes less daunting thanks to various state and local programs designed to assist first-time or low-income homebuyers. These programs often provide down payment assistance or favorable loan terms that can bridge gaps left by traditional financing options.

To maximize these opportunities, research extensively or consult housing agencies within your state or locality that specialize in such programs they could hold the key to unlocking your future home!

The Home Buying Process with a 500 Credit Score

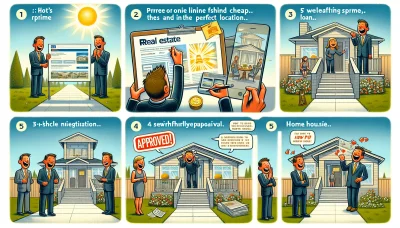

Preparing for the Home Search

Assessing Your Financial Health

Embarking on the home buying journey with a 500 credit score necessitates a thorough assessment of your financial health. It's crucial to scrutinize your credit report for errors and identify areas for improvement. Addressing outstanding debts and establishing a history of consistent payments can incrementally boost your credit score, making you more attractive to lenders.

Additionally, accumulating a substantial down payment can be a game-changer. Lenders might still consider your application if you bring more to the table upfront, which also reduces your loan amount and potentially secures better terms.

Setting Realistic Expectations

With a 500 credit score, setting realistic expectations is paramount. Understand that your options may be limited and interest rates higher. It's essential to determine what you can afford monthly, factoring in mortgage payments, insurance, taxes, and maintenance costs. Aim for properties within this budget to avoid financial strain.

Exploring various mortgage products designed for lower credit scores, such as FHA loans, might offer avenues to homeownership that conventional loans do not. These specialized products often come with more flexible qualification criteria.

Working with a Real Estate Agent

A savvy real estate agent can be your ally when purchasing a home with a low credit score. They possess the expertise to navigate the market and can pinpoint properties that align with both your financial situation and housing needs. Their negotiation skills may also prove invaluable when it comes time to make an offer.

Your agent should understand the challenges associated with lower credit scores and be prepared to work diligently on your behalf. They can provide guidance on improving your creditworthiness in the eyes of sellers and lenders alike.

Making an Offer on a Home

Understanding the Offer Process

The offer process begins with due diligenceresearching comparable property prices ensures your offer is competitive yet reasonable. A compelling offer often includes not just the price but terms favorable to the seller, such as flexibility on closing dates or minimal contingencies.

Expect negotiations after submitting an offer; it's rare for a first offer to be accepted outright. Be prepared to adjust terms or price based on seller feedback while keeping within your budgetary constraints.

Negotiating with Sellers

Negotiations are where your real estate agent shines, advocating for terms that satisfy both you and the seller. A solid strategy and clear communication are key elements in successful negotiations. Remember, every aspect of the sale is negotiablefrom price to repair credits.

Maintain flexibility but also know your limits during this phase; being too rigid could mean losing out on the right property, while too much leniency could lead to unfavorable terms or overextension of your finances.

Contingencies and Clauses in an Offer

- Inspection Contingency: This allows you to have the property inspected and possibly renegotiate or withdraw if significant issues are found.

- Financing Contingency: Protects you if you're unable to secure financing by enabling contract termination without penalty.

- Appraisal Contingency: Ensures that you're not paying more than the property's appraised valuea safeguard against overinvestment.

- Title Contingency: Verifies clear title transfer without legal encumbrances or disputes affecting ownership rights.

- Sale Contingency: If you need to sell your current home before purchasing another, this clause makes the new purchase dependent on that sale.

Closing the Deal

What Happens at Closing?

Closing is when ownership officially transfers from seller to buyerit's the finish line of the home buying process! You'll sign legal documents including the mortgage agreement and property deed. Ensure you understand every paper before signing; this is legally binding!

This final step involves numerous parties: buyers, sellers, their respective agents, attorneys (if applicable), and often a representative from the lending institution. All must coordinate for a successful closing day.

Closing Costs and How to Manage Them

Closing costs can take buyers by surprise; they typically range from 2% to 5% of the loan amount and include fees for loan processing, title search, insurance, and more. Budgeting for these costs early avoids last-minute financial stress.

Negotiating with sellers for contributions towards closing costs can sometimes be an optionyour real estate agent's negotiation skills again play an important role here in reducing out-of-pocket expenses at closing time.

Finalizing the Mortgage and Ownership Transfer

The moment has arrivedfinalizing your mortgage! You'll agree upon terms with lenders who will then disburse funds covering the home purchase. This marks your transition from buyer to homeownera monumental milestone!

The transfer of ownership is recorded through legal documents at this stage too. Once registered at local land records offices, congratulations are in orderyou now own a piece of real estate!

Overcoming Challenges in the Home Buying Journey

Dealing with Rejection from Lenders

Reasons for Mortgage Denial

Understanding why lenders reject mortgage applications is crucial. Common causes include poor credit history, high debt-to-income ratios, and unstable employment. Lenders scrutinize these factors to assess risk before approving loans. Applicants should review their credit reports and financial stability to anticipate potential issues.

How to Respond to a Rejection

Receiving a mortgage rejection can be disheartening, but it's not the end of the road. Seek clarity on the reasons for denial; this information is key to making necessary improvements. Consider credit counseling or financial advice to address underlying issues. Persistence and corrective action can turn a rejection into an approval.

Reapplying for a Mortgage After Rejection

When reapplying for a mortgage, ensure that you've addressed the lender's concerns. This may involve improving your credit score, reducing debts, or saving for a larger down payment. It's also beneficial to shop around for different lenders who may have more favorable terms or be more willing to work with your specific situation.

Navigating High-Interest Rates and Fees

Impact of High Rates on Monthly Payments

The burden of high-interest rates cannot be overstated; they significantly increase monthly payments and the total cost of a home loan. Prospective buyers must understand how rates affect their budget and overall financial plan. A lower rate could mean saving thousands over the life of the loan.

Strategies to Minimize Fees and Costs

- Improve Your Credit Score: A higher credit score can help secure lower interest rates.

- Negotiate with Lenders: Don't hesitate to negotiate origination fees and closing costs.

- Larger Down Payment: Save for a larger down payment to reduce loan amount and possibly qualify for better rates.

- Shop Around: Compare offers from multiple lenders to find the most competitive rates and fees.

- Purchase Points: Consider buying discount points upfront to lower your interest rate over time.

Refinancing Options for the Future

If you're locked into a high-interest rate, refinancing could be a strategic move once rates decline or your financial situation improves. This can lead to lower monthly payments or shorter loan terms. Keep abreast of market trends and maintain good credit health to capitalize on refinancing opportunities when they arise.

Managing Expectations and Emotional Stress

Staying Positive During the Search

The house hunt can be long and taxing, but maintaining positivity is vital. Celebrate small victories along the way and remain adaptable in your search criteria. Support from friends, family, or a dedicated real estate agent can provide encouragement during challenging times.

Coping with Setbacks and Delays

Setbacks are an inevitable part of the home buying journey, whether due to bidding wars or unexpected repairs needed on a potential home. Developing resilience through these challenges is essential; take breaks when needed, reassess priorities, and keep lines of communication open with all parties involved.

Keeping Focus on Long-Term Goals

Purchasing a home is not just about navigating current obstacles; it's about keeping an eye on the prizeyour long-term goals. A clear vision of what you want in a home will guide you through tough decisions and help you stay on track towards finding that perfect place where memories will unfold for years to come.

Strategies to Improve Your Credit Score Before Buying a Home

Understanding Your Credit Report

Your credit report is a detailed dossier of your credit history, and it's critical to know what it contains. By understanding your report, you can pinpoint areas for improvement and start taking action!

How to Obtain Your Credit Report: You're entitled to a free credit report every year from each of the three major bureaus. Get yours through AnnualCreditReport.com and start examining it closely.

Identifying Errors and Disputing Them: Errors can drag your score down! Scrutinize every detail for inaccuracies, and don't hesitate to dispute them. This could lead to quick score improvements.

Importance of Regular Credit Monitoring: Stay vigilant by monitoring your credit regularly. This way, you'll catch any suspicious activity early on and keep your credit history spotless.

Building a Positive Credit History

Timely Bill Payments and Their Impact: Paying bills on time is non-negotiable! It's the single most powerful factor in building a positive credit history and soaring scores.

The Benefits of Low Credit Utilization: Keep your credit card balances low compared to limits. Ideally, aim for under 30% utilization to show lenders you're not over-reliant on credit.

Importance of Diverse Credit Accounts: A mix of different types of credit can benefit your scorethink auto loans, credit cards, and mortgages. It shows you can handle various types of borrowing responsibly.

Short-Term vs. Long-Term Credit Improvement Tactics

Quick Fixes to Boost Your Score Temporarily: Need a fast boost? Pay down balances or become an authorized user on a well-managed account. But remember, these are short-term strategies!

- Sustainable Habits for Ongoing Credit Health:

- Prioritize consistent, timely payments they're the backbone of your credit score.

- Maintain low balances on lines of credit to avoid high utilization rates.

- Avoid opening several new accounts at once; this can lower your average account age.

- Regularly review your credit report to ensure accuracy and track progress.

When to Consider Professional Credit Counseling: If you're overwhelmed, seek out professional counseling. They can offer personalized strategies tailored just for youbecause sometimes we all need an expert helping hand!

The Role of Down Payments in Home Purchases with Low Credit Scores

Understanding Down Payment Requirements

Down payments are a critical aspect of purchasing a home, especially for those with lower credit scores. A substantial down payment can sometimes offset the risk lenders take on with lower credit applicants, potentially leading to more favorable loan terms. It's a show of financial commitment that lenders weigh heavily.

Minimum Down Payment Expectations by Loan Type: Various mortgage products have distinct minimum down payment requirements. For example, conventional loans typically need at least 5%, while FHA loans can go as low as 3.5% for qualified buyers. Understanding these requirements is key for budgeting and planning.

How Down Payments Affect Loan-to-Value Ratio: The down payment directly impacts your loan-to-value ratio (LTV), which is a lender's risk assessment tool. A higher down payment results in a lower LTV, indicating less risk to the lender and often leading to better loan conditions.

The Relationship Between Down Payments and Interest Rates: Generally, a larger down payment can secure a lower interest rate since it reduces the lender's exposure to potential loss. This could save homeowners thousands over the life of their mortgage.

Saving Strategies for a Larger Down Payment

Saving for a larger down payment is an effective strategy to enhance your mortgage options and reduce overall costs. It requires discipline and a solid plan to accumulate the necessary funds over time.

Budgeting Tips for Homebuyers: Create a detailed budget that prioritizes savings, cut unnecessary expenses, and set clear goals. Automating savings can also ensure consistent progress towards your down payment goal.

- Track all expenses and identify areas to reduce spending.

- Set specific saving milestones with corresponding timelines.

- Consider side gigs or overtime work for additional income.

- Avoid high-interest debt that can hinder your saving ability.

High-Yield Savings Accounts and Other Vehicles: Place your savings in high-yield accounts or other investment vehicles that offer better returns than traditional savings accounts. Research options like CDs or money market accounts for higher interest rates with low risk.

Assistance Programs for Down Payment Support: Look into local and federal assistance programs designed to help homebuyers with their down payments. These can include grants, forgivable loans, or matched savings programs that boost your down payment funds.

Creative Solutions for Down Payment Challenges

Finding creative solutions to amass a down payment can make homeownership attainable even when traditional saving methods fall short. Exploring unconventional avenues may provide the necessary capital to bridge the gap.

Gifts and Loans from Family Members: Receiving gifts or loans from family can significantly contribute to your down payment fund. Ensure any monetary gifts are documented properly to satisfy lender requirements without impacting loan eligibility.

Crowdfunding Your Home Purchase: Crowdfunding has emerged as a novel way to raise funds for various goals, including home purchases. Platforms dedicated to this purpose allow friends, family, and even strangers to contribute towards your dream of homeownership.

Exploring Employer-Assisted Housing Programs: Some employers offer housing assistance programs as part of their benefits package. These may include direct financial assistance, interest-free loans, or matching grants which all aid in accumulating a sufficient down payment more quickly.

Real Estate Market Considerations for Buyers with Low Credit Scores

Timing the Market with a Low Credit Score

Navigating the real estate market with a low credit score demands strategic timing. Understanding when to step into the market can make a significant difference in affordability and loan terms. Buyers should stay informed about interest rate trends and housing market forecasts to make educated decisions.

Advantages of Buying in a Buyer's Market: A buyer's market presents unique opportunities for those with lower credit scores. Sellers may be more willing to negotiate, potentially leading to better prices or favorable terms, which could offset some credit disadvantages.

Risks of Waiting for Market Changes: While timing the market can be beneficial, it also carries risks. Holding out for a more favorable market might backfire if interest rates rise or credit standards tighten, making it even harder for buyers with low scores to secure financing.

Seasonal Trends in Real Estate: Seasonal fluctuations can impact inventory and pricing. Typically, spring brings more listings but also more competition, while winter may offer fewer options but better deals for buyers ready to move quickly.

Location Factors in Home Buying Decisions

The location of your potential home plays a critical role in the buying process, affecting everything from lifestyle to investment potential. Buyers need to weigh the pros and cons of different settings based on their personal needs and financial situation.

Urban vs. Rural: Pros and Cons: Urban areas often offer convenience and amenities but come with higher costs and property taxes. Rural areas may provide more affordable housing options but could lack certain services and have longer commute times.

Property Taxes and Their Impact on Affordability: Property taxes can vary dramatically by location and significantly affect the overall cost of homeownership. It's crucial for buyers, especially those with low credit scores, to consider these long-term expenses.

School Districts and Property Values: The quality of local schools can influence property values. Even if buyers without children may overlook this factor, it's important to consider for resale value.

Types of Properties Suitable for Low-Credit Buyers

Different types of properties come with varying levels of investment risk and potential return. For buyers with low credit scores, understanding which types of properties are most suitable is essential in making a smart purchase decision.

Single-Family Homes vs. Condos: Single-family homes typically offer more space and privacy but may require higher down payments and maintenance costs. Condos might have lower entry costs and less upkeep but come with association fees that can impact affordability.

Fixer-Uppers: Potential and Pitfalls:

- Potential: Fixer-uppers can be a great deal if priced correctly, offering the chance for sweat equity and customization that fits your budget.

- Pitfalls: However, renovation costs can spiral out of control without proper planning or expertise, potentially turning into financial sinkholes.

- Tips:

- Carefully assess repair costs before purchasing by consulting with contractors or home inspectors.

- Budget extra funds for unforeseen expenses that are common in renovations.

- Evaluate whether you have the time, skills, and resources to manage a fixer-upper project effectively.

New Construction vs. Existing Homes: New constructions offer modern amenities and warranties but may be priced at a premium. Existing homes might offer better value but could require immediate upgrades or repairs that challenge a limited budget.

Post-Purchase Considerations: Maintaining Homeownership with a 500 Credit Score

Budgeting for Homeownership Expenses

Managing finances as a homeowner requires meticulous budgeting, especially with a credit score around 500. Anticipate not just your mortgage, but also the recurring costs of homeownership. This includes utility bills, homeowner's association fees, and general maintenance expenses which can fluctuate seasonally.

Regular maintenance is not just a responsibility; it's a financial strategy that prevents costlier issues down the line. Set aside funds each month for routine upkeep such as lawn care, HVAC servicing, and pest control to avoid unexpected financial strains.

Emergency repairs will test both your nerves and your wallet. Whether it's a burst pipe or a broken furnace, having an emergency fund is critical. Start with small contributions to this fund and build it over time to cushion the financial shock of these inevitable repairs.

Don't overlook annual expenses like property taxes and home insurance premiums in your budget. These can be significant and are often paid in lump sums. Consider escrow accounts offered by lenders to spread these large payments over the year.

Regular Maintenance and Upkeep Costs

Maintaining your home goes beyond cosmetic updates; it involves regular checks on structural elements and systems. Inspect your roof, foundation, and plumbing regularly to identify potential issues early. Remember, prevention is cheaper than cure!

Invest in energy-efficient appliances and fixtures. They reduce monthly bills and contribute to long-term savings. Also, don't forget about the landscape maintaining outdoor spaces prevents property damage and keeps your home looking great!

Planning for Emergency Repairs

- Know Your Resources: Research local contractors and keep a list of trusted professionals for quick access during emergencies.

- Maintain a Dedicated Savings Account: Allocate funds specifically for home emergencies to ensure youre financially prepared when issues arise.

- Stay Informed: Understand common household problems and their signs so you can act swiftly before they escalate.

- Prioritize Repairs: Address critical repairs immediately to prevent further damage and more expensive fixes later on.

- Consider Insurance Coverage: Review your home insurance policy details to know whats covered, helping mitigate out-of-pocket expenses during emergencies.

Property Taxes and Home Insurance

Your obligations don't end with mortgage payments; property taxes are a perpetual expense that can rise over time. Familiarize yourself with tax assessments in your area to avoid being caught off guard by increases.

Adequate home insurance safeguards you against unforeseen events but comes at a recurring cost. Shop around for policies every few years you might find better rates or coverage that aligns more closely with your current needs.

Strategies for Refinancing and Building Equity

If interest rates drop or your credit score improves significantly, refinancing could be advantageous. It can lower monthly payments or shorten loan terms, but calculate closing costs before proceeding to ensure it's worthwhile.

Increase home equity by making improvements that boost property value or by paying down mortgage principal faster. Consider renovations that have high returns on investment, like updating kitchens or bathrooms.

Making extra mortgage payments directly towards the principal reduces overall interest paid and accelerates equity building. Even periodic additional payments can make a substantial difference over the life of the loan.

When to Consider Refinancing Your Mortgage

Analyze market conditions regularly; if rates have dropped since you secured your mortgage, refinancing might save you money. However, timing is crucial weigh the benefits against how long you plan to stay in your home.

Ways to Increase Home Equity Over Time

Paying more than the minimum mortgage payment monthly can slowly but surely increase equity. Additionally, any upgrades that enhance curb appeal or functionality can contribute positively to your home's equity growth.

Benefits of Extra Mortgage Payments

The benefits of additional mortgage payments are twofold: reduced interest expenses over time and quicker ownership of your asset. It's a powerful strategy that requires discipline but pays off generously in financial freedom later on.

Protecting Your Investment for the Future

A home warranty can be a lifesaver when major systems fail unexpectedly. While not a substitute for insurance, warranties offer added protection for appliances and systems not covered under standard policies.