Home buying mistakes to avoid Quiz

Test Your Knowledge

Question of

Ignoring Pre-Approval Process

Understanding Your Budget

Hey there, future homeowners! Are you ready to dive into the world of real estate? Well, hold your horses! Before you start dreaming about that perfect kitchen or the backyard pool, let's talk about a CRUCIAL step you might be overlooking the pre-approval process. It's not just a formality; it's your financial blueprint! By assessing your financial health, you're setting yourself up for success. You need to know what you can afford before falling in love with a property that's way out of your budget. Trust me, it's heartbreak waiting to happen!

And it's not just about knowing what you can spend; it's also about showing sellers that you mean business. When you have that pre-approval letter in hand, it screams commitment and readiness to seal the deal. It tells them, "I've done my homework, and I'm not here to play!" So folks, don't skip this step. It's the cornerstone of a savvy home-buying strategy!

Importance of Mortgage Limits

Now let's get down to brass tacks! Understanding mortgage limits is like having a secret weapon in the world of real estate negotiations. Its your shield against getting swept away by emotion and making an offer on a home that'll stretch your finances too thin. Remember, just because you're approved for a certain amount doesn't mean you should spend it all. Be smart, be strategic, and keep those future financial goals in sight!

Mortgage limits are there for a reason they're like the guardrails on your path to homeownership. They keep you safe from veering off into the land of overwhelming debt. So when you sit down with lenders, ask questions, understand every detail of your mortgage limit, and then plan accordingly. This isn't just buying a house; it's investing in your future!

Choosing the Right Lender

Ladies and gentlemen, brace yourselves for an adventure because choosing the right lender is like embarking on a quest for the Holy Grail! It can make or break your home-buying experience. You want someone who offers not just competitive interest rates but also stellar customer service and guidance through this rollercoaster ride.

Its time to put on your detective hat and do some sleuthing! Compare those interest rates like theyre clues leading to the treasure chest which in this case is an affordable loan that suits your financial situation perfectly. And dont stop there; dig deeper into each lenders reputation because lets face it no one wants to be stuck with a lender who doesnt have their back.

- Comparing Interest Rates: This isn't just about finding the lowest number; it's about uncovering the true cost over time. Look beyond the surface and consider factors like points, fees, and flexibility.

- Evaluating Lender Reputation: Read reviews, ask for recommendations, and check their history with regulatory bodies. A lenders track record can tell you volumes about what to expect during your home-buying journey.

Overlooking Property Inspections

Importance of Professional Inspections

Hey there, future homeowners! Are you ready to dive into the world of real estate? Well, buckle up because I'm about to drop some knowledge bombs on you! First things first: professional property inspections are your best friend when it comes to home buying. You might be thinking, "But wait, they look perfect!" Hold that thought! Looks can be deceiving, and that's why you need a pro to dig deep into what lies beneath.

Now, let's talk about identifying hidden issues. We're talking about those sneaky little problems that aren't visible to the naked eye. These can range from outdated wiring that could moonlight as a fire starter, to a charming vintage fireplace that's actually a safety hazard. A professional inspector has the eagle eyes needed to spot these issues before they turn into your worst nightmare. And guess what? This isn't just about peace of mind; it's also about saving you a boatload of cash in the long run. Nipping these problems in the bud means avoiding costly repairs down the road. So yes, inspections are a big deal!

Types of Inspections to Consider

Alrighty, let's break down the types of inspections that should be on your radar. First up, structural integrity checks because nobody wants their dream home turning into the Leaning Tower of Pisa! A qualified inspector will scrutinize the foundation, walls, and roof to ensure everything is solid and up to code. It's like giving your house a full health check-up!

Next on the list: pest and mold assessments. Termites and other critters love making themselves at home in your potential abode, often unbeknownst to you. And mold? It's not just unsightly; it can be downright unhealthy! These assessments are crucial for ensuring your new place isn't hosting unwanted guests or harboring health hazards. Here's a quick rundown:

- Structural Integrity Checks: Assess the bones of your potential home for any signs of weakness or deterioration.

- Pest Assessments: Uncover any infestations or damage caused by insects or rodents.

- Mold Inspections: Detect any presence of mold which could impact air quality and health.

Remember folks, when it comes to buying a house, it's what's on the inside that counts too! Don't skip out on property inspections they're an absolute must in your home-buying journey. Trust me; this is one step you'll thank yourself for later.

Neglecting Neighborhood Research

When it comes to home buying, the mantra "location, location, location" cannot be overstated! One of the colossal mistakes a homebuyer can make is neglecting neighborhood research. It's not just about the walls and roof; it's about the tapestry of community that surrounds your potential new home. The neighborhood dictates not only your lifestyle but also the future value of your investment. So, before you leap into making an offer, take a deep dive into understanding the local scene!

Think about it: you're not just buying a house; you're investing in a slice of the local area. What's happening on those streets? Are there plans for a mega-mall next door or a new park? These factors are pivotal! They can transform your quiet retreat into a bustling hub or vice versa. Overlooking this critical aspect of home buying could lead to regrettable outcomes. Don't let that happen to youbecome a neighborhood detective and uncover all there is to know!

The savvy buyer knows that thorough neighborhood research is non-negotiable. It's about protecting your investment and ensuring your home is a sanctuary, not just in the present but for years to come. So, roll up those sleeves and start researching! This isn't just due diligence; it's about crafting the life you want and securing your financial future in real estate.

Evaluating Local Amenities

Local amenities are like the seasoning to your home-owning experiencethey can enhance it significantly! Evaluating these amenities is absolutely essential when considering a new neighborhood. Look around: Are there parks for weekend picnics? Gyms for keeping fit? Coffee shops for those morning caffeine fixes? These conveniences contribute massively to your quality of life and can even boost your property's value over time!

But waitthere's more! Amenities aren't just about leisure and convenience; they're also about practicality. Proximity to schools and hospitals can be game-changers for families and individuals alike. Imagine being able to walk your kids to school each day or having quick access to medical care when needed. These considerations are paramount and should be high on your checklist when scouting out potential neighborhoods.

And don't forget access to public transportation! If you're commuting or love to explore without driving, this is HUGE! Being near buses, trains, or subways can save you time, money, and stress. It's an often overlooked aspect that deserves your full attention because let me tell you, easy commutes are worth their weight in gold!

- Proximity to Schools and Hospitals: A top priority for families looking for convenience and peace of mind.

- Access to Public Transportation: An absolute must-have for commuters and eco-conscious residents.

Understanding Future Developments

Now hold onto your hats because we're diving into something that could dramatically influence your home's future valueunderstanding potential developments in the area! You've got to have an eye on what tomorrow might bring. Will there be skyscrapers blocking your sunset view? Or maybe a new community center boosting local engagement? These developments can shape the entire character of a neighborhood!

Zoning laws might sound dry as dust, but they're actually treasure maps guiding where developments can occur. Get familiar with them! They'll tell you if that charming little park will stay that way or if it's destined to become condos. And believe me, knowing these laws puts you ahead of the gameit arms you with knowledge on how the area might evolve.

And let's talk about appreciation potentialmusic to any homeowners ears! If theres one thing you want from real estate investment, its growth in value. Understanding what drives property appreciation in an area is like having a crystal ball. It helps predict whether todays sleepy street is tomorrows hot spot. So get out there and learn about planned infrastructure, commercial projects, and other factors that could turn todays purchase into tomorrows jackpot!

Underestimating Additional Costs

Homebuyers, listen up! The journey to homeownership is exhilarating, but don't let the thrill of the chase cause you to overlook the hidden costs that come with buying a property. It's not just about the sticker price; there are additional expenses that can sneak up on you and wreak havoc on your finances if you're not prepared. Let's dive into what you need to consider beyond the down payment!

Remember, every dollar counts when you're investing in real estate! We're talking about costs that go beyond the mortgageexpenses that many first-time buyers often miss. From property taxes to utility bills, these are not just numbers; they are crucial aspects of your home-buying budget. By acknowledging these costs early on, you'll be setting yourself up for a smoother financial ride as a proud new homeowner.

Now, let's break down these costs so you can approach your real estate investment with eyes wide open! You've got to be on top of every expense, and that means planning for everything from appraisal fees to moving costs. This isn't just advice; it's a necessity for stepping into homeownership with confidence and security.

Budgeting for Closing Expenses

Closing costs are no joke! They can represent a significant chunk of your home purchase price, and they're often underestimated by many buyers. We're talking legal fees, title insurance, and moreexpenses that ensure your home is yours legally and without dispute. This is not an area where you want surprises, so lets get into the nitty-gritty of what these costs entail.

When budgeting for closing expenses, think about every detail. These aren't just line items; they're the final steps in securing your dream home! You need to account for everything from loan origination fees to credit report charges. And don't forget about escrow deposits! These are critical components of your closing costs and should never be overlooked.

Be vigilant and informed! Understanding these expenses is key to a successful real estate transaction. This isn't just about being cautious; it's about being smart with your money. The more you know about closing costs, the better prepared you'll be to handle them without breaking a sweat.

Legal Fees and Taxes

Legal fees and taxes: two terms that might not spark excitement but are absolutely essential in the home-buying process! Legal fees cover the cost of lawyers who ensure that the property transaction is above boardthis is non-negotiable peace of mind we're talking about here. And then there are taxesproperty transfer taxes, to be exactwhich can vary widely depending on where you buy.

This isn't just paperwork; this is protecting your investment! You need a skilled professional who will navigate the complexities of real estate law on your behalf. And when it comes to taxes, knowledge is power! Be aware of what's expected in your jurisdiction so there are no surprises come tax time.

The bottom line? Don't underestimate these expenses! They may not be the most thrilling part of buying a home, but they are absolutely critical for a seamless transition into homeownership. Treat them with respect and plan accordingly!

Home Insurance and Warranties

You wouldn't drive a car without insurance, so why would you own a home without it? Home insurance is an absolute mustit protects your property against unforeseen events like fires or natural disasters. But it doesn't stop there; warranties also play a vital role in safeguarding your investment against defects or issues with appliances and systems within the home.

This is about safeguarding your sanctuary! Home insurance offers peace of mind, ensuring that if disaster strikes, you wont be left out in the cold (literally). And warranties? Theyre like having a safety net for your appliances and systemsa way to avoid unexpected repair bills that can strain any budget.

Take action now! Research different insurance policies and warranty plans before closing on your house. This isn't an optional step; its an integral part of responsible homeownership. Make sure youre covered from day oneyoull thank yourself later!

Planning for Maintenance and Upkeep

Maintenance and upkeep: they might not be glamorous, but they are essential aspects of owning a home that lasts! Regular maintenance helps preserve the value of your property and prevents minor issues from turning into costly disasters. It's all about being proactive rather than reactivethis isnt just maintenance; its smart homeownership!

Your house is more than just walls and a roofit's a complex structure requiring ongoing care. From cleaning gutters to servicing HVAC systems, regular upkeep ensures everything runs smoothly. Ignore this at your peril because maintenance isn't optionalit's absolutely necessary for keeping your home in tip-top shape!

Maintenance matters! Its not just about fixing things when they break; its about preventing problems before they start. A well-maintained home is more than just comfortableits cost-effective in the long run.

Regular Home Care Costs

- Lawn care services: Keep your curb appeal sharp!

- HVAC maintenance: Essential for comfort year-round!

- Pest control: Dont let critters settle in uninvited!

- Gutter cleaning: Avoid water damage with regular checks!

- Routine inspections: Stay ahead of potential issues!

This list isnt exhaustiveits merely scratching the surface! Think beyond these examples because every aspect of your home requires attention over time. Ignoring any one of these can lead to bigger problems down the roadand bigger hits to your wallet too.

Emergency Repair Fund

An emergency repair fund: this isnt optionalits essential! Life happens, pipes burst, roofs leakand when they do, having funds set aside can mean the difference between a quick fix and financial turmoil.

This fund isnt just another savings account; its financial security specific to homeownership needs. It ensures that when something goes wrongand eventually something willyoure prepared without having to scramble or incur debt.

Youve got this! Start building up an emergency fund as soon as possible because this isnt pessimism; its practicality at its finesta true mark of responsible homeownership.

Skipping the Long-Term Perspective

Hey there, future homeowners! Are you ready to leap into the exciting world of real estate? Hold on tight because we're about to dive into why keeping a long-term perspective is absolutely CRUCIAL when buying your dream home! This isn't just advice; it's the golden ticket to ensuring you make a smart investment that will have you grinning for years to come!

Considering Future Needs

Imagine this: You've found a cute little house that seems perfect NOW, but fast-forward a few years, and suddenly it's like trying to fit an elephant in a suitcase it just doesn't work anymore! That's why considering future needs is not just important it's essential! Think about what life might throw at you. Maybe a growing family, perhaps an office for your skyrocketing career, or even space for a personal gym because lets face it, who doesnt want to be in tip-top shape?

Room for Growth

Think BIG! Even if you're as cozy as a bug in a rug right now, life changes faster than the latest smartphone model! When looking at potential homes, ask yourself: Is there room for an extra bedroom? Can I expand the living space? Is the backyard big enough for future landscaping dreams? Purchasing with room for growth isn't just smart; it's thinking ahead like a chess grandmaster planning their winning move!

Resale Value Factors

Bingo! You've got to think about resale value from day one! It's like buying a car you wouldn't get one that loses half its value when you drive off the lot, right? The same goes for houses. Consider factors like location, neighborhood development plans, and school districts. These aren't just bullet points on a list; they're the bread and butter of your home's future worth. And trust me, when it's time to sell, you'll be thanking your lucky stars you thought ahead!

Adapting to Market Trends

The real estate market is like a roller coaster thrilling but unpredictable! To avoid being caught off guard, adapting to market trends is not just wise; its non-negotiable! Stay informed about whats hot and whats not in the housing market. Its not about following the herd; its about making informed decisions that align with market dynamics. This way, youre not just buying a house; youre making an investment that stands strong against the test of time.

Monitoring Real Estate Cycles

Hear me out! Real estate cycles are as real as gravity, and they can have a massive impact on your property's value. By monitoring these cycles closely, you can predict when to buy low and sell high it's like having insider info on the stock market! Keep tabs on housing demand trends, interest rates, and construction booms. This isn't just playing detective; it's arming yourself with knowledge that could pay off big time!

Predicting Economic Shifts

- Economic Indicators: Keep an eye on job growth numbers and unemployment rates they're like the pulse of the economy.

- Mortgage Rate Movements: They can swing your decision from "Yes!" to "Nope!" faster than you can say "fixed-rate."

- Fiscal Policies: Government decisions can either pour fuel or water on your real estate fire stay alert!

Catching economic shifts before they happen isn't just guesswork; it requires vigilance and foresight. By being one step ahead of economic changes, you're setting yourself up for success. You're not just buying property; you're securing your financial fortress against whatever may come your way. So gear up with this knowledge and watch as your real estate journey becomes nothing short of legendary!

Rushing the Buying Process

Hold your horses, future homeowners! Diving headfirst into the home buying process without a solid plan is like trying to bake a cake without a recipe it's a recipe for disaster! The real estate market is brimming with options, and rushing could lead to overlooking critical flaws or missing out on that perfect property. It's crucial to pump the brakes and ensure you're not making a hasty decision that you might regret later. Remember, this is not just any purchase; it's a monumental commitment that deserves your time and attention.

Patience is key! When it comes to real estate investments, haste makes waste. You need to explore every nook and cranny of the market before making your move. This isn't just about finding a house; it's about discovering your future home. So, take a deep breath, slow down, and let's make sure you're equipped with all the knowledge to avoid those pesky home buying pitfalls!

Taking Time to Compare Options

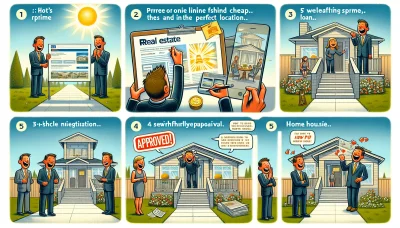

Exploring Diverse Listings

Get ready for an adventure through the real estate jungle! Exploring diverse listings is like going on a treasure hunt you never know what gem you might uncover. With countless properties available, it's essential to sift through the options with a fine-tooth comb. Don't settle for the first house that catches your eye; there are so many more waiting to steal your heart! By comparing different homes, neighborhoods, and their unique features, you'll gain a comprehensive understanding of what's out there.

And guess what? This isn't just about aesthetics; it's about making an informed decision that aligns with your lifestyle and future goals. Whether it's proximity to top-notch schools or a vibrant community culture, every detail matters in this grand scheme. So embrace the diversity of listings and let them guide you towards your ideal home!

Weighing Pros and Cons

It's time to play detective! Every home has its secrets advantages that make it shine and drawbacks that could be deal-breakers. Your mission is to uncover these mysteries by weighing the pros and cons meticulously. Create a list check it twice and evaluate how each property measures up against your dream home criteria.

This analytical approach will illuminate the path forward, helping you discern which properties are truly contenders in this thrilling race towards homeownership. Remember, this isn't just about today; it's about envisioning your life years down the line in this space. So scrutinize those lists and make choices that will stand the test of time!

Avoiding Impulse Decisions

Importance of Second Opinions

Calling all confidants! When emotions run high, and excitement clouds judgment, seeking second opinions can be your saving grace. This is where family, friends, or even trusted real estate advisors come into play. They serve as your sounding board, offering fresh perspectives that might reveal aspects you hadn't considered.

- Consult with seasoned homeowners who have been through this rodeo before.

- Gather insights from local residents to get the lowdown on neighborhood dynamics.

- Engage with professional inspectors who can spot potential issues before they become costly repairs.

Their input can be invaluable in ensuring you're not blinded by the glitz of granite countertops or swayed by stunning hardwood floors alone. Lean on their wisdom to navigate these waters wisely!

Reflecting on Personal Criteria

Let's get personal! Your home should be a reflection of YOU accommodating not only your present needs but also those of future-you. Before taking the plunge into homeownership, reflect deeply on your personal criteria. What does your ideal living situation look like? Are we talking urban chic or suburban retreat?

Determine what non-negotiables will make daily living comfortable and joyful for you and possibly your family. Do you crave a quiet study or need room for an expanding brood? Reflecting on these personal preferences will act as a compass guiding you through the sea of options towards a place that feels like home sweet home.

Disregarding Professional Advice

Listen up, future homeowners! The path to securing your dream home is fraught with potential pitfalls, but I'm here to guide you through the maze! One of the most critical mistakes you can make is to disregard professional advice. It's a jungle out there, and you need seasoned experts who can help you dodge the traps and snare that perfect property deal!

Embarking on the home buying journey solo might seem like a cost-saving strategy, but it's a treacherous path! Without the right advice, you could end up overpaying, getting entangled in legal issues, or missing out on hidden gems. Trust me, tapping into professional knowledge isn't just smart; it's essential for a successful purchase that won't haunt your finances for years to come!

Remember, professionals are armed with insider insights and experience that are invaluable. They're your knights in shining armor in the real estate realm, ready to battle on your behalf. So, buckle up and let's dive into why their expertise is non-negotiable!

Leveraging Real Estate Agents' Expertise

Real estate agents are your golden ticket to navigating the complex world of property acquisition! They're not just agents; they're your strategic allies equipped with a wealth of knowledge that's crucial for making informed decisions. They understand market trends, neighborhood dynamics, and have a sixth sense for valuing properties.

Think of them as your personal real estate gurus who can sniff out the best deals and steer you clear of those money pits. With an agent by your side, you're not just buying a house; you're making a calculated investment in your future!

And let's talk about negotiations oh boy, can they negotiate! They'll haggle like there's no tomorrow to ensure you don't pay a penny more than you should. Their negotiation skills alone are worth their weight in gold!

Navigating Paperwork and Negotiations

The paperwork involved in buying a home can be downright daunting! But fear not real estate agents eat paperwork for breakfast! They'll guide you through every form and document with the precision of a surgeon.

Attention to detail? Check. Understanding complex clauses? Double-check. They'll ensure every 'i' is dotted and every 't' is crossed so that when it comes time to sign on the dotted line, you do so with confidence and clarity.

No need for cold sweats at night worrying about legal jargon your agent has got this covered! And when it comes time to face off with sellers or their agents, yours will be right there in the trenches, ensuring you emerge victorious with terms that favor YOU!

Accessing Exclusive Listings

- Hidden Market Wonders: Your real estate agent has access to listings that haven't hit the public eye yet think of them as secret menu items that only VIPs get to order!

- Sneak Peeks: They can get you into homes before open houses even happen. That means first dibs on making an offer on that dream abode.

- VIP Treatment: With an agent's network, you get exclusive access to properties that might never be listed online or in newspapers. It's like having backstage passes to the hottest show in town home buying!

Seeking Legal and Financial Counsel

We're diving deep now legal and financial counsel is where things get serious. These experts are like the guardians at the gate of your future home. Without them, you might unwittingly walk into a minefield of legal complications or financial disasters.

Their advice isn't just helpful; it's critical for peace of mind and financial security. They'll help you navigate through murky waters and ensure your investment is sound as a pound!

You wouldn't perform surgery on yourself without a doctor, right? So why would you navigate one of lifes biggest purchases without a legal and financial expert? Its simple: You wouldnt or at least, you shouldnt!

Understanding Contractual Obligations

A contract isn't just another piece of paper; it's a binding agreement that dictates how smooth or bumpy your home buying ride will be. Legal advisors dissect contracts like master chefs filleting fish with precision and expertise.

You need someone who knows their stuff when it comes down to easements, encroachments, contingencies all those big words that could spell big trouble if not handled correctly. Your legal eagle will ensure that what you sign protects YOUR interests above all else.

No surprises here just clear-cut explanations and guidance so that every clause works in your favor. This isn't just about avoiding mistakes; its about creating success from the start!

Structuring Sound Investment Strategies

Your financial advisor is like the grandmaster of chess always thinking several moves ahead. They'll craft an investment strategy for your home purchase that aligns with your long-term financial goals.

This isnt about spending money; its about investing it wisely so that over time, your property becomes more than just a home it becomes a cornerstone of your wealth-building journey.